Emily's list: Quality over quantity edition

Updated: 2012-07-31 13:03:37

: Living with credit 481 New , interesting products 103 Research , regulation , industry reports 238 Rewards 47 Protecting yourself 175 The fine print 78 Credit card miscellany 383 Celebrity Money Watch 5 Print Email Emily's list : Quality over quantity edition Emily Starbuck Crone July 20, 2012 Living with credit I was talking to a friend this week who lamented that it's finally time for her to buy a nice purse . She's a very frugal girl who puts any extra money toward her two passions : travel and sports . After tearing through tons of cheap Target purses , she said she finally needed to cough up the money for a nice bag . The thought of possibly spending the equivalent of a plane ticket on one , however , made her cringe . It's funny because I went through the exact same thing just a

: Living with credit 481 New , interesting products 103 Research , regulation , industry reports 238 Rewards 47 Protecting yourself 175 The fine print 78 Credit card miscellany 383 Celebrity Money Watch 5 Print Email Emily's list : Quality over quantity edition Emily Starbuck Crone July 20, 2012 Living with credit I was talking to a friend this week who lamented that it's finally time for her to buy a nice purse . She's a very frugal girl who puts any extra money toward her two passions : travel and sports . After tearing through tons of cheap Target purses , she said she finally needed to cough up the money for a nice bag . The thought of possibly spending the equivalent of a plane ticket on one , however , made her cringe . It's funny because I went through the exact same thing just a

It's one of the spookiest days of the year again. I'm not sure if it's related to this creepy date, but something weird has definitely been going on in the United States for the last two weeks. Read on for my roundup of my 10 favorite personal finance blog posts from the past week, many of which can help you get your finances prepared for a weather-related emergency.

It's one of the spookiest days of the year again. I'm not sure if it's related to this creepy date, but something weird has definitely been going on in the United States for the last two weeks. Read on for my roundup of my 10 favorite personal finance blog posts from the past week, many of which can help you get your finances prepared for a weather-related emergency. Last weekend, I went to Las Vegas for the first time and learned what a money pit the city can be. Learn more about my trip and explore my roundup of my 10 favorite personal finance blog posts from the past week!

Last weekend, I went to Las Vegas for the first time and learned what a money pit the city can be. Learn more about my trip and explore my roundup of my 10 favorite personal finance blog posts from the past week! I am all for being free to manage my money and debt -- and doing it successfully. To celebrate, enjoy my roundup of my 10 favorite personal finance blog posts from the past week -- some of which speak about financial independence.

I am all for being free to manage my money and debt -- and doing it successfully. To celebrate, enjoy my roundup of my 10 favorite personal finance blog posts from the past week -- some of which speak about financial independence. While my affection for roller coasters has most definitely waned since my childhood, I'm reminded of its treacherous ups and downs and fleetingly temporary plateaus when I reflect upon giving my 18-year-old son his most important financial lessons -- including earning a fantastic credit score -- before he heads off to college this fall.

While my affection for roller coasters has most definitely waned since my childhood, I'm reminded of its treacherous ups and downs and fleetingly temporary plateaus when I reflect upon giving my 18-year-old son his most important financial lessons -- including earning a fantastic credit score -- before he heads off to college this fall. I've said it before and I'll say it again: I credit my parents with my financial responsibility. This Father's Day, I want to give a shout-out to all of th dads who also helped shape their kids to be financially responsible. Sure, many of us go to college and make some bad decisions, or struggle a bit right out of school. But parents who teach us financial literacy at a young age give us invaluable tools that will last us a lifetime, especially once we're a bit more mature and can really put those lessons into action.

Read on for my recap of my top 10 favorite personal finance blog posts from this week.

I've said it before and I'll say it again: I credit my parents with my financial responsibility. This Father's Day, I want to give a shout-out to all of th dads who also helped shape their kids to be financially responsible. Sure, many of us go to college and make some bad decisions, or struggle a bit right out of school. But parents who teach us financial literacy at a young age give us invaluable tools that will last us a lifetime, especially once we're a bit more mature and can really put those lessons into action.

Read on for my recap of my top 10 favorite personal finance blog posts from this week. You know it's summer here in Texas when a quick walk around the block with your dog leaves you looking like you just ran a 5k. Besides dripping in sweat, the other thing I do often in the summer is travel. In this week's roundup of my favorite personal finance blog posts, I'm featuring posts all about saving money on summer travel and making the most of your hard-earned vacations!

You know it's summer here in Texas when a quick walk around the block with your dog leaves you looking like you just ran a 5k. Besides dripping in sweat, the other thing I do often in the summer is travel. In this week's roundup of my favorite personal finance blog posts, I'm featuring posts all about saving money on summer travel and making the most of your hard-earned vacations! Do you have a strategy for making prepayments on your credit card balance? See how you can make the best use of early payments on a credit card.

Do you have a strategy for making prepayments on your credit card balance? See how you can make the best use of early payments on a credit card. Are you aware of the age restrictions used when analyzing your credit card application? Learn how you can avoid them and obtain a credit card?

Are you aware of the age restrictions used when analyzing your credit card application? Learn how you can avoid them and obtain a credit card? Read this guide to international credit card use before you travel. One tip just might save you thousands of dollars!

Read this guide to international credit card use before you travel. One tip just might save you thousands of dollars! Learn how to claim travel insurance benefits on your credit card account. Travel insurance protects you from financial risk in the event you cannot make it to your favorite travel destination.

Learn how to claim travel insurance benefits on your credit card account. Travel insurance protects you from financial risk in the event you cannot make it to your favorite travel destination. Credit cards have their pros and cons, but are they right for everyone? Should students have a credit card?

Credit cards have their pros and cons, but are they right for everyone? Should students have a credit card? Know the difference between secured and unsecured credit cards before you apply. Here is everything you need to know about the two types of credit cards.

Know the difference between secured and unsecured credit cards before you apply. Here is everything you need to know about the two types of credit cards. Have you ever thought that you can save while buying a car with your credit card? Believe it or not but it's true especially you are buying a used one.

Have you ever thought that you can save while buying a car with your credit card? Believe it or not but it's true especially you are buying a used one. Have you ever heard about the "Debt Snowball"? It's a well known technique that helps you to repay your debts faster.

Have you ever heard about the "Debt Snowball"? It's a well known technique that helps you to repay your debts faster. Rewards credit cards are not for everyone. See who should – and who shouldn’t – have a credit card.

Rewards credit cards are not for everyone. See who should – and who shouldn’t – have a credit card.  Personalizing a credit card isn’t just for show-offs. See how personalization can save you time at the checkout line.

Personalizing a credit card isn’t just for show-offs. See how personalization can save you time at the checkout line. Paying down debt shouldn’t be stressful. Here are some tips to avoid the stress of too much credit card debt.

Paying down debt shouldn’t be stressful. Here are some tips to avoid the stress of too much credit card debt. Price assurance is a hot benefit in credit cards. See how you can benefit from price assurance on your high-end credit cards.

Price assurance is a hot benefit in credit cards. See how you can benefit from price assurance on your high-end credit cards. Credit card rewards pay people to use credit cards. Learn more about how rewards work, and how much you can earn with your credit card.

Credit card rewards pay people to use credit cards. Learn more about how rewards work, and how much you can earn with your credit card. Changing a credit card due date is a great way to never miss a payment and consolidate your finances. Learn how to pick a new due date for your credit cards.

Changing a credit card due date is a great way to never miss a payment and consolidate your finances. Learn how to pick a new due date for your credit cards. Know these 5 things before you open a joint account. We’ll share all the must know, vital information to consider when opening a joint credit card account.

Know these 5 things before you open a joint account. We’ll share all the must know, vital information to consider when opening a joint credit card account. Learn what you must know about your credit report and score. Did you know these 3 important facts?

Learn what you must know about your credit report and score. Did you know these 3 important facts? Make your voice heard! A new government agency makes it easier to communicate concerns about any financial product online in a public format viewable by anyone. Learn how it works.

Make your voice heard! A new government agency makes it easier to communicate concerns about any financial product online in a public format viewable by anyone. Learn how it works. Bankruptcy is not the end to your life with credit. We'll show you how to start rebuilding your credit immediately after a bankruptcy filing.

Bankruptcy is not the end to your life with credit. We'll show you how to start rebuilding your credit immediately after a bankruptcy filing. Several reasons why you should choose a store co-branded credit card instead of a simple one.

Several reasons why you should choose a store co-branded credit card instead of a simple one. If your credit history doesn't allow you to get a regular credit card, you can always choose a secured one, which is a viable alternative.

If your credit history doesn't allow you to get a regular credit card, you can always choose a secured one, which is a viable alternative. Some people use balance transfer arbitrage to make hundreds of dollars per year with their credit cards. See how they do it.

Some people use balance transfer arbitrage to make hundreds of dollars per year with their credit cards. See how they do it. Play Your Way to Healthy Finances With Four Awesome Budgeting Games by Ben DeMeter on July 30, 2012 Budgeting and saving money may be the responsible things for any working stiff to do , but that doesn’t make them any fun . But all of that changes when you turn good financial planning into a video game . Then , saving becomes surprisingly . enjoyable For years , reports have been circulating around the Internet on how popular games like World of Warcraft and FarmVille inadvertently teach players good financial planning through the use of an in-game economy and currency . A number of developers are now taking this revelation one step further with apps and online games designed to help users reach their financial goals through a video-game-style leveling system . This new breed of software

Play Your Way to Healthy Finances With Four Awesome Budgeting Games by Ben DeMeter on July 30, 2012 Budgeting and saving money may be the responsible things for any working stiff to do , but that doesn’t make them any fun . But all of that changes when you turn good financial planning into a video game . Then , saving becomes surprisingly . enjoyable For years , reports have been circulating around the Internet on how popular games like World of Warcraft and FarmVille inadvertently teach players good financial planning through the use of an in-game economy and currency . A number of developers are now taking this revelation one step further with apps and online games designed to help users reach their financial goals through a video-game-style leveling system . This new breed of software Awesome Ways to React After Your Credit Card Has Been Declined by Ben DeMeter on July 28, 2012 So you’re standing in line at National Superstore waiting to purchase Necessary Household Item . The pretty young cashier calls you up , you exchange meaningless pleasantries about your purchase and then she scans your Necessary Household Item and places it in a . bag Will that be all It will . be How will you be paying You’ll be paying with . plastic You hand her your credit card . Smiling , she swipes it . Then she stops smiling . She scratches her head and swipes the card again . Her brow furrows . It’s then that you realize that that beautiful smile is gone for . good I’m sorry sir , she says , but your credit card has been declined . The moments that follow rank among the most awkward in the

Awesome Ways to React After Your Credit Card Has Been Declined by Ben DeMeter on July 28, 2012 So you’re standing in line at National Superstore waiting to purchase Necessary Household Item . The pretty young cashier calls you up , you exchange meaningless pleasantries about your purchase and then she scans your Necessary Household Item and places it in a . bag Will that be all It will . be How will you be paying You’ll be paying with . plastic You hand her your credit card . Smiling , she swipes it . Then she stops smiling . She scratches her head and swipes the card again . Her brow furrows . It’s then that you realize that that beautiful smile is gone for . good I’m sorry sir , she says , but your credit card has been declined . The moments that follow rank among the most awkward in the 4 Famous Rich People Who Ended Up Dying Penniless by Ben DeMeter on July 27, 2012 Fame is great . Fame can make you a household name . Fame can make you powerful . Most importantly , fame can make you very rich . But the problem with fame is that it’s fleeting . One day the world loves you , but by the next day people have already moved on to something else . Then you’re suddenly stuck with a lot of savings and a very limited . income Converting fifteen minutes of fame into a comfortable nest egg requires patience , sacrifice and some thoughtful budgeting , and these are not skills that many celebrities possess . Far too often , the world’s biggest stars get caught up in their lavish lifestyles and end up spending and spending long after the well has dried up . Some stars , like Mark Twain

4 Famous Rich People Who Ended Up Dying Penniless by Ben DeMeter on July 27, 2012 Fame is great . Fame can make you a household name . Fame can make you powerful . Most importantly , fame can make you very rich . But the problem with fame is that it’s fleeting . One day the world loves you , but by the next day people have already moved on to something else . Then you’re suddenly stuck with a lot of savings and a very limited . income Converting fifteen minutes of fame into a comfortable nest egg requires patience , sacrifice and some thoughtful budgeting , and these are not skills that many celebrities possess . Far too often , the world’s biggest stars get caught up in their lavish lifestyles and end up spending and spending long after the well has dried up . Some stars , like Mark Twain Inventive Horrific Punishments for Debtors Throughout History by Ben DeMeter on July 26, 2012 If you think that getting hounded by collection agencies for your credit card debt is unbearable , then thank your lucky stars that you weren’t born 700 years ago . A few angry phone calls and a lower credit score are nothing compared to the methods people used to deal with debtors back back in medieval and Renaissance . times If you didn’t pay down your debts when armor-clad knights were still in vogue , you would most likely be paraded around town by your creditors , who would then remove a few of your body parts as a penalty . And that’s only if they decided to go easy on you . If leniency wasn’t in the cards for you , then well , why don’t you just read on to find out Here’s a look back at

Inventive Horrific Punishments for Debtors Throughout History by Ben DeMeter on July 26, 2012 If you think that getting hounded by collection agencies for your credit card debt is unbearable , then thank your lucky stars that you weren’t born 700 years ago . A few angry phone calls and a lower credit score are nothing compared to the methods people used to deal with debtors back back in medieval and Renaissance . times If you didn’t pay down your debts when armor-clad knights were still in vogue , you would most likely be paraded around town by your creditors , who would then remove a few of your body parts as a penalty . And that’s only if they decided to go easy on you . If leniency wasn’t in the cards for you , then well , why don’t you just read on to find out Here’s a look back at We are excited to introduce our newest partnership with GoAbroad.com. They have been around since 1999 providing comprehensive online resources for students planning to travel overseas. Today, they will feature some helpful tips on travel visas – an important issue facing any international students planning to go abroad. Visas may be one of the most [...]

We are excited to introduce our newest partnership with GoAbroad.com. They have been around since 1999 providing comprehensive online resources for students planning to travel overseas. Today, they will feature some helpful tips on travel visas – an important issue facing any international students planning to go abroad. Visas may be one of the most [...] Posting Photos of Your Credit Cards on Twitter Prepare for a Public Shaming by Ben DeMeter on July 25, 2012 Personal information , like Social Security numbers and credit card numbers , is supposed to be kept private . We feel that this is a fairly easy concept to understand . But when we log into Twitter and take a look around , our faith in humanity crumbles . Why Because every day , dozens of Twitter users upload pictures of their credit and debit cards to the massive social network without censoring the information on the card face . We’re not kidding this is something that people actually do . And quite frankly , we’re flabbergasted . Posting your credit and debit account numbers to one of the world’s largest social networks is so irresponsible that it gives us a migraine just

Posting Photos of Your Credit Cards on Twitter Prepare for a Public Shaming by Ben DeMeter on July 25, 2012 Personal information , like Social Security numbers and credit card numbers , is supposed to be kept private . We feel that this is a fairly easy concept to understand . But when we log into Twitter and take a look around , our faith in humanity crumbles . Why Because every day , dozens of Twitter users upload pictures of their credit and debit cards to the massive social network without censoring the information on the card face . We’re not kidding this is something that people actually do . And quite frankly , we’re flabbergasted . Posting your credit and debit account numbers to one of the world’s largest social networks is so irresponsible that it gives us a migraine just 4 Awesome Gadgets That Look Like Credit Cards But Aren’t by Ben DeMeter on July 24, 2012 So you’re walking home from the office , minding your own business , when a mugger reaches out and pulls you into a dark . alley Gimme your wallet he . says You hand over your wallet , but first you remove a certain black credit card . These are all self-explanatory , you tell your assailant , but this one’s a little different . No information on the face , see Technology these days , huh Here , I’ll show you how to find it . Hurry up , the mugger says , menacingly , while looking around in a stereotypical mugger” sort of . way You unfold your credit card like a piece of origami , revealing it to be not a card at all but a vicious little combat knife . You charge forward and , not being the killing

4 Awesome Gadgets That Look Like Credit Cards But Aren’t by Ben DeMeter on July 24, 2012 So you’re walking home from the office , minding your own business , when a mugger reaches out and pulls you into a dark . alley Gimme your wallet he . says You hand over your wallet , but first you remove a certain black credit card . These are all self-explanatory , you tell your assailant , but this one’s a little different . No information on the face , see Technology these days , huh Here , I’ll show you how to find it . Hurry up , the mugger says , menacingly , while looking around in a stereotypical mugger” sort of . way You unfold your credit card like a piece of origami , revealing it to be not a card at all but a vicious little combat knife . You charge forward and , not being the killing International students looking to finance their education in the United States have many options available including scholarships, grants and other financial aid options. Even with this, students may soon find that they need additional help to cover their tuition, books, travel, housing, living expenses and other fees. In situations like this, a private international student [...]

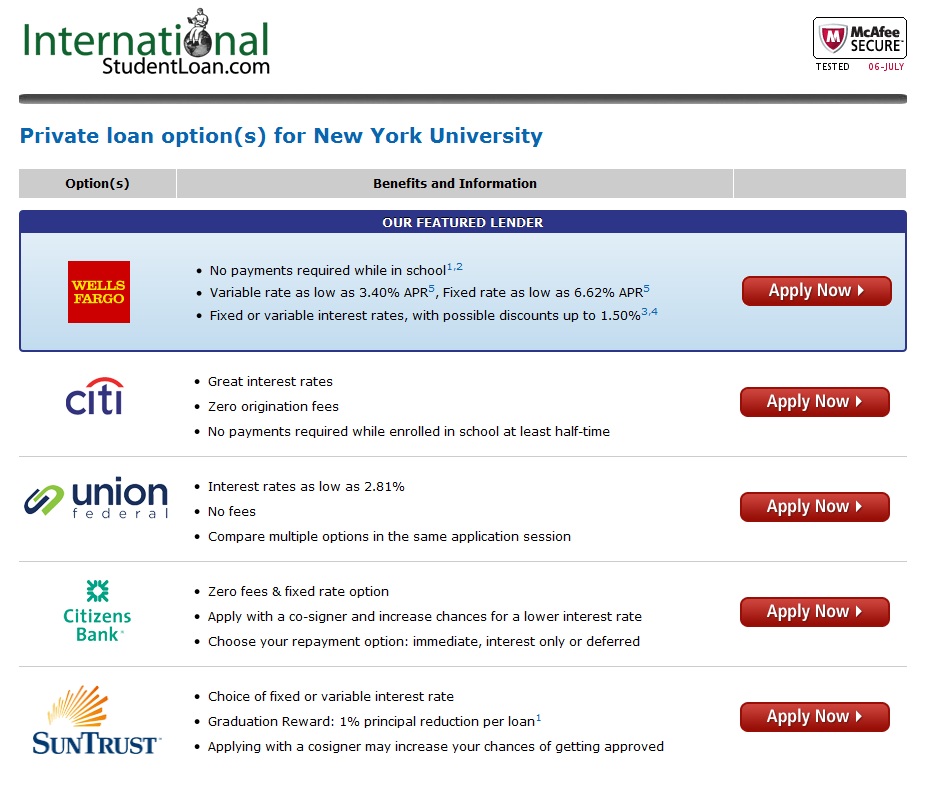

International students looking to finance their education in the United States have many options available including scholarships, grants and other financial aid options. Even with this, students may soon find that they need additional help to cover their tuition, books, travel, housing, living expenses and other fees. In situations like this, a private international student [...] CFPB and FDIC Subpoena Discover in Payment Protection Probe by Ben DeMeter on July 6, 2012 Payment protection plans are to credit card issuers what paint protection plans are to used car dealerships an easy way to scam unwitting customers out of their money . We’ve been saying this for a while now . We even broke down the costs and found that if an insurance company were to charge the same rates that card issuers charge for a similar protection service , it would be considered illegal . The costs would literally be criminally high Finally , it looks like the government is starting come around to our way of thinking . This week , the Consumer Financial Protection Bureau and the Federal Deposit Insurance Corporation officially subpoenaed Discover Financial Services over the card issuer’s

CFPB and FDIC Subpoena Discover in Payment Protection Probe by Ben DeMeter on July 6, 2012 Payment protection plans are to credit card issuers what paint protection plans are to used car dealerships an easy way to scam unwitting customers out of their money . We’ve been saying this for a while now . We even broke down the costs and found that if an insurance company were to charge the same rates that card issuers charge for a similar protection service , it would be considered illegal . The costs would literally be criminally high Finally , it looks like the government is starting come around to our way of thinking . This week , the Consumer Financial Protection Bureau and the Federal Deposit Insurance Corporation officially subpoenaed Discover Financial Services over the card issuer’s Your 100 Accurate Financial Horoscope for July by Ben DeMeter on July 5, 2012 It’s time again for everyone’s favorite column of the month , your 100 accurate financial horoscope . We’ve held council with the heavens and have learned the terrible , curious and occasionally glorious fates that await your savings accounts in the month of July . Prepare your tender hearts , dear readers , because this is about to get . interesting Aries March 21 April 19 Jupiter says it’s taking the kids and moving in with Saturn , and this puts you in a difficult position , Aries . Without the solar system’s help , you won’t be able to afford that life-saving surgery you’ll need pretty soon . You can either make friends with someone who has two good kidneys and your blood type or you can redeem yourself in

Your 100 Accurate Financial Horoscope for July by Ben DeMeter on July 5, 2012 It’s time again for everyone’s favorite column of the month , your 100 accurate financial horoscope . We’ve held council with the heavens and have learned the terrible , curious and occasionally glorious fates that await your savings accounts in the month of July . Prepare your tender hearts , dear readers , because this is about to get . interesting Aries March 21 April 19 Jupiter says it’s taking the kids and moving in with Saturn , and this puts you in a difficult position , Aries . Without the solar system’s help , you won’t be able to afford that life-saving surgery you’ll need pretty soon . You can either make friends with someone who has two good kidneys and your blood type or you can redeem yourself in